O Que É Pip Forex

This article volition focus on the minimum price change known as pip. You will observe out how much it is, why nosotros measure cost movements in them and whether the pip is the aforementioned for all trading instruments. What can I say – in that location are pips and then in that location are other pips, and information technology'southward important to empathise the pips meaning.

Pip trading depends on many things, and a trader has to know what position size, footing indicate and pip motility mean. Allow's try to find out!

The article covers the following subjects:

- Pips Definition & Pregnant

- Calculating Pip value

- Finding Pip value in the trading account

- Major currencies pips: Forex

- Pips and cost movement

- What is a Pipette/Point?

- Cost of ane indicate on Forex

- Pips FAQ

Pips Definition & Meaning

I will non torment the reader with a long introduction. A pip is a full general term for the minimum unit of measurement of price modify. The term is mostly popular among Forex traders because it'south inconvenient to summate miniscule fluctuations of currencies in dollars or euros. It'south easier to say that the price grew by 540 pips than 0.0054 euros, isn't it?

An important detail about the FX pip is that it depends on the accuracy of the price measurement. Some brokers offering 4-digit quotes – here the accuracy of price measurement is limited to ten thousandths. In this case, the alter of the 5th decimal bespeak in the EUR/USD cost - for instance, from 1.00000 to 1.00004 - will become unnoticed. A one-pip change for a 4-digit Forex broker volition equal a x pip price change for a 5-digit quote.

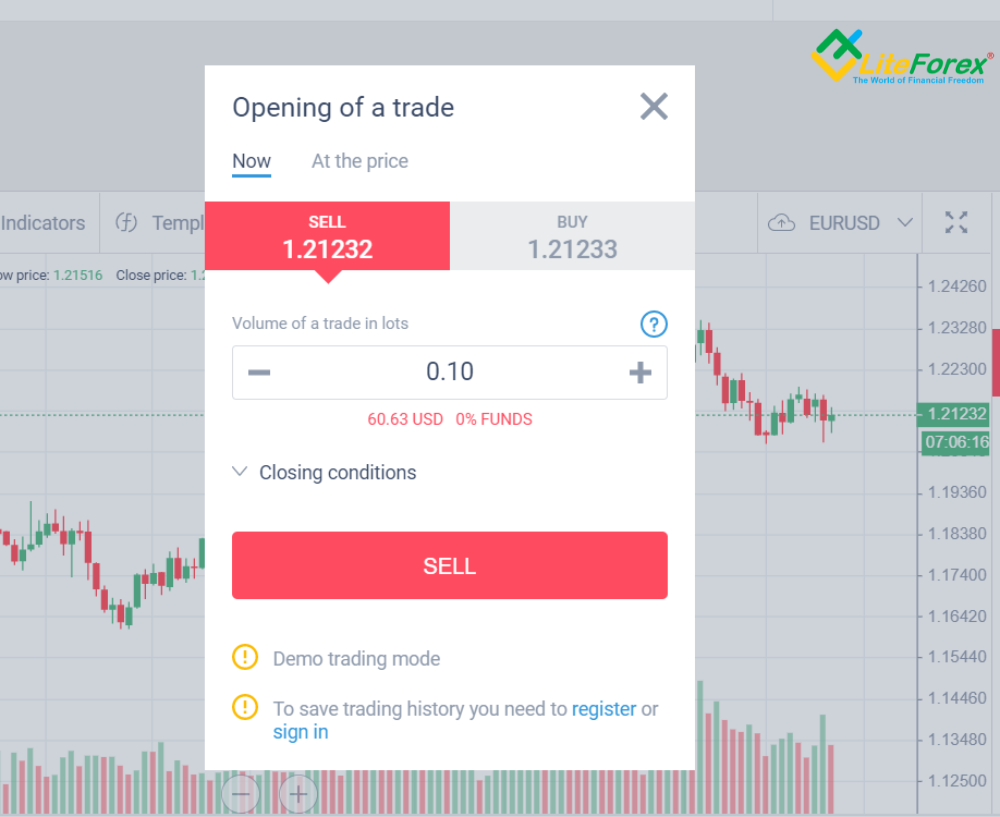

Let us consider the spread for the EUR/USD currency pair

The substitution rate is 1.21232 to 1.21233:

-

the best sell price is EUR 1.21232,

-

the best buy price is EUR one.21233.

The spread, or the difference between the quotes, is EUR 0.00001 or 1 pip. As you have probably guessed, Litefinance provides 5-digit quotes.

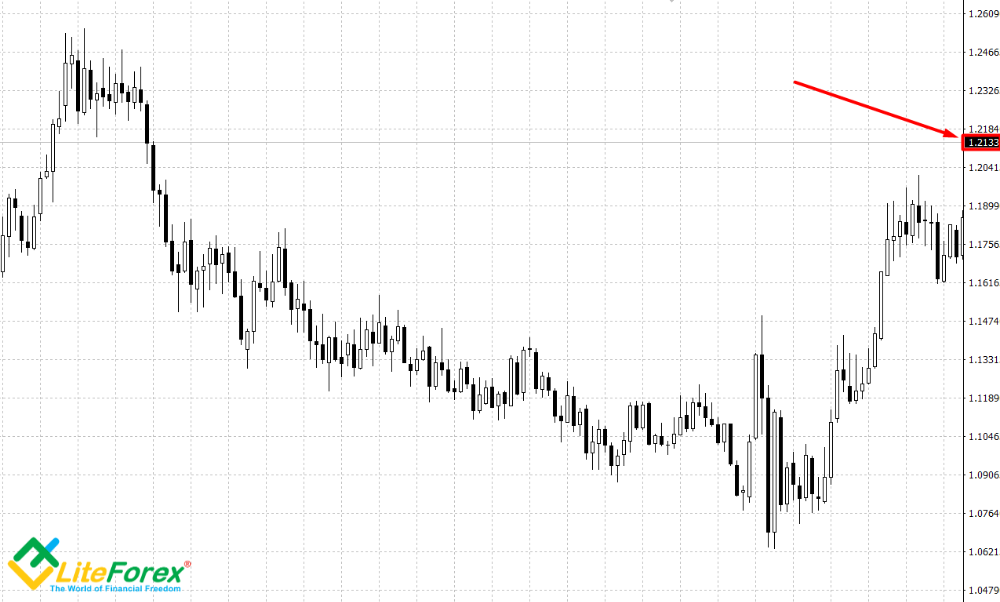

Speaking nearly the minimum price move, let's analyze how the price of this instrument (EUR/USD) has inverse during 5 minutes on a minute timeframe (M1).

The price is at the level of 1.21247.

After x minutes, the price increased slightly - to 1.21250.

The timeframe is small, that's why the growth is then pocket-size

It turns out that the price has grown by three pips from 1.21250 to one.21247 or by EUR 0.00003.

The pip value of 0.00001 is also called "fractional pip" considering it is ane/10 of the "standard" value with a iv-digit quote.

Calculating Pip value

To do this, we need to know:

-

the cost of ane lot of the traded instrument. On Forex, it is usually 100,000 units of the base of operations currency (which is the first in the quote). For example, the cost of 1 lot of the EUR/USD = 100,000 euros. The cost of 1 lot of the GBP/JPY = 100,000 pounds, etc.

-

The cost of the instrument. Let's have EUR/USD once again. At a charge per unit of one.20000, buying 1 lot (100,000 euros) will toll 100,000 x i.20 = 120,000 dollars.

If we sell i lot at a price one pip higher, i.eastward. by i.20001, every bit a result of such a trading operation nosotros get 100,000 10 1.20001 = 120,001 US dollar. Therefore, we tin can earn i dollar on a move of i pip, which is the cost of i pip on this musical instrument.

Other instruments are calculated using the same method.

Let'south take the USD/JPY as an case of unconventional 3 decimal digits in the exchange rate adding.

Toll of 1 lot - USD 100,000

We'll presume the rate of the musical instrument is 105.300

In the instance with the dollar and the yen, the minimum cost fluctuation would exist 0.001

When buying ane lot of the USD/JPY, yous need 100,000 * 105,300 = x,530,000 Japanese yen.

If the rate rises by i pip to 105.301, so i lot (100,000 U.s.a. dollars) tin be sold at 10,530,100 yen.

Therefore, the value of 1 pip here will be 10,530,100 - x,530,000 = 100 yen.

Finding Pip value in the trading account

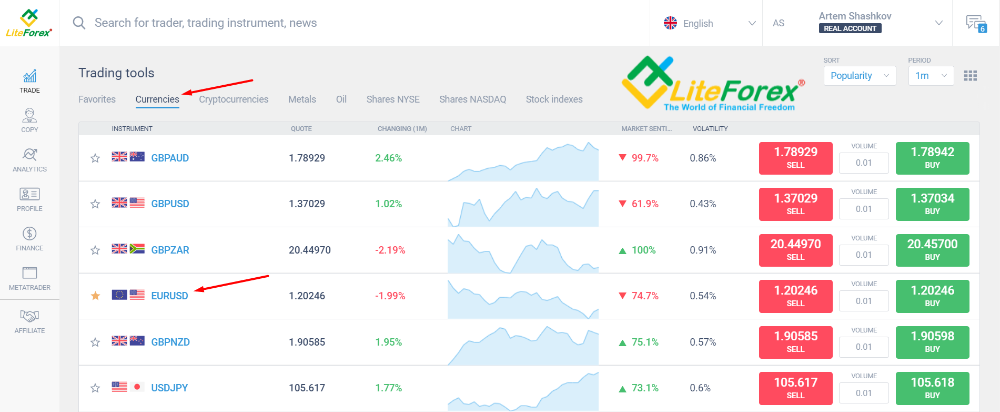

Some of the values for calculating pip value on the Forex marketplace can be plant in the trading account. Let's open a nautical chart of the EUR/USD currency pair in the online last. To do this, select the "currencies" tab and click on the EUR/USD pair.

The scale in the right corner of the nautical chart shows the electric current price of the musical instrument. It sits at a value of $1.20241.

Nosotros have a 5-digit quote, which ways that the minimum price change for this instrument will be $0.00001.

To calculate the value of one pip, y'all also demand to know the volume of the transaction, which is measured in lots. The selected volume value is shown to the right of the chart:

Every bit the volume of the transaction grows, the value of one pip for the trader also increases. Every bit nosotros found out before, with a volume of 1 lot, the cost of a pip is $1. This means that with a minimum volume of 0.01 lot, the cost of a pip will be equal to $ 0.01. In this instance, the trader will be able to earn $0.5 on the price move of 50 pips.

If you increase the volume to 0.1, the cost of 1 pip will also increase 10 times - from $0.01 to $0.1. Then the same motility of 50 pips can bring the trader $5.

Information technology is crucial to understand that any trade e'er has 2 potential outcomes. So earlier playing with volumes, it is recommended that the trader should acquire bones knowledge of hazard and money direction.

Major currencies pips: Forex

The major currency pairs are called the Majors. These include:

-

EUR/USD (Euro - Usa Dollar)

-

USD/CHF (US dollar - Swiss franc)

-

GBP/USD (British Pound - US Dollar)

-

USD/JPY (The states Dollar - Japanese Yen)

-

USD/CAD (US Dollar - Canadian Dollar)

-

AUD/USD (Australian dollar - U.s. dollar)

-

NZD/USD (New Zealand Dollar - U.s. Dollar)

All these instruments accept 5-digit quotes, except for the USD/JPY, which has 3 decimal places.

The toll of 1 lot for each instrument is 100,000 units of the base (first in the quote) currency:

| EUR/USD | 100,000 euro |

| USD/CHF | 100,000 United states dollars |

| GBP/USD | 100,000 pounds |

| USD/JPY | 100,000 Us dollars |

| AUD/USD | 100,000 Australian dollars |

| USD/CAD | 100,000 Usa dollars |

| NZD/USD | 100,000 New Zealand dollars |

Now let'due south add 1 pip value for each currency pair and calculate its value for a standard volume of 1 lot.

| EUR/USD | 100,000 euro | 0.00001 USD | 1 USD |

| USD/CHF | 100,000 United states of america dollars | 0.00001 CHF | 1 CHF |

| GBP/USD | 100,000 pounds | 0.00001 USD | 1 USD |

| USD/JPY | 100,000 Usa dollars | 0.001 JPY | 100 JPY |

| AUD/USD | 100,000 Australian dollars | 0.00001 USD | 0.5 USD |

| USD/CAD | 100,000 United states dollars | 0.00001 CAD | i CAD |

| NZD/USD | 100,000 New Zealand dollars | 0.00001 USD | ane USD |

Depending on the currency in which the trader keeps their trading majuscule, these values will be converted based on the current rate.

For the calculation you lot will need:

- The toll of one pip of the traded instrument. For case, a trader is trading the USD/CHF. So the cost of 1 pip is measured in CHF and is i CHF.

- The exchange rate ratio of the business relationship currency to the currency in which nosotros're calculating the value of i bespeak. In our case, nosotros demand the USD to CHF rate.

For a trader'due south business relationship in USD, the cost of 1 point of the USD/CHF currency pair at its rate of 0.90000 will be calculated every bit follows:

Point value for an account in USD = 1 CHF / 0.90000 = one.11 USD

If a trader with an business relationship in USD wants to trade the USD/JPY pair with the charge per unit 105,600, then the pip value for their account in USD will exist every bit follows:

Calculating the Forex pip value for an account in USD = 100 JPY / 105,600 = 0.95 USD

When you've mastered the basics of calculation, y'all can utilize the trader'due south figurer to salve time:

Pips and cost motility

Calculating the value of potential profit or loss is of practical importance for the trader's assay. Based on these values, the trader tin summate the trade book that fits their take chances management rules and trading capital.

For such calculations y'all will demand:

-

calculate the value of a pip of a traded instrument in the business relationship currency with a standard volume of ane lot;

-

calculate the possible loss in the account currency: how much the trader will lose when the terminate loss is triggered. This can be done using the formula:

Stop loss for standard volume (in account currency) = pip value in account currency 10 End loss value in pips

-

Calculate the trade book based on the risk management rules.

Suppose a trader is trading the EUR/USD currency pair on a USD trading account. They want to place a stop loss of twenty pips with $200 of trading capital.

-

The cost of a pip with a volume of 1 lot = ane USD

-

When setting a stop loss of xx pips in the case of a i lot merchandise, the trader should risk:

Pip value * Stop loss value in pips = $20

-

Suppose a trader does non want to hazard more than than 3% of the deposit per merchandise. With a majuscule of $200, this will be $200 * 0.03 = $six

If the stop loss with a book of one lot is $20, so the trader will need to cut the trade volume:

$20 / $vi = three.33.

Consequently, the merchandise volume with such risk management parameters should be iii.33 times less than the standard volume of ane lot.

Therefore, the maximum possible volume, taking into account all the rules and parameters, will be equal to one / 3.33 = 0.3 lot

What is a Pipette/Signal?

What is 1 betoken or pipette and how are they different from a pip?

On exchange markets - stock, futures, etc. - points are the toll values before the decimal point.

For case, if the toll of AMZN shares rose from 3284.7 to 3305.four in a day, stock traders say that the toll grew by 21 points.

Partial price values (after the decimal point) are non taken into account:

3305 - 3284 = 21 pips.

If you merchandise contracts for divergence (CFDs), whose prices are calculated somewhat similarly to exchange instruments, then even on Forex i betoken will have the same pregnant for you.

A Forex point can betoken not only the minimum possible toll move, only also a specific amount of cost change equal to 0.00001. Some Forex traders differentiate betwixt the concepts of a pip and a bespeak.

Since previously, about Forex brokers provided 2-digit (case - USD/JPY) and 4-digit (example - EUR/USD) quotes, the minimum price movements were 0.01 and 0.0001, respectively. This is what was referred to as a pip.

Pay attending to the screenshot of a 4-digit quote from the Metatrader concluding.

In fourth dimension calculations of cost changes became more than nuanced with the help of 3-digit (USD/JPY) and 5-digit (EUR/USD) quotes. Then the minimum toll change for the USD/JPY became 0.001, and for the EUR/USD - 0.00001.

Therefore, for old schoolhouse traders the value of 1 pip is yet a price change of 0.01 or 0.0001, and more than authentic changes of 0.001 and 0.00001 were called a betoken or a beautiful word "pipette".

Therefore, if the charge per unit of the currency pair increased from 1.20251 to 1.20274, then the growth was 2 pips or 23 points:

1.20274 - ane.20251 = 0.00023

So, using the case of some musical instrument measured in US dollars,

Commutation: $1 = 1 point

Forex market: a pip is equal to a point and is $0.00001 or $0.0001 with a 4-digit quote.

Toll of i point on Forex

If you lot are a stock trader, the value of a point for you volition be equivalent to the measurement unit of the value of the traded instrument.

If the instrument is traded in US dollars, then i point will exist equivalent to $1. If information technology's in euros, so 1 euro.

For Forex traders, 1 point is the same as i pip, and then it volition exist calculated in the same way.

P.S. Did you like my commodity? Share it in social networks: it will be the best "thank yous" :)

Ask me questions and comment below. I'll be glad to answer your questions and give necessary explanations.

Useful links:

- I recommend trying to trade with a reliable broker hither. The arrangement allows y'all to trade past yourself or copy successful traders from all across the globe.

- Use my promo-code BLOG for getting deposit bonus 50% on LiteFinance platform. Just enter this code in the advisable field while depositing your trading account.

- Telegram conversation for traders: https://t.me/liteforexengchat. We are sharing the signals and trading experience

- Telegram channel with high-quality analytics, Forex reviews, preparation manufactures, and other useful things for traders https://t.me/liteforex

Pips FAQ

A point on Forex is the minimum toll change. With a 4-digit quote, it volition be equal to 0.0001. With five digits - to 0.00001

The cost of 1 bespeak depends on the traded musical instrument and on the volume of the transaction. In the case of trading currency pairs, the value of 1 point is measured in the quoted currency, which is listed 2nd in the quote. For example, when trading the GBP/USD with a minimum volume of 0.01 lot, the price of 1 point will exist equal to 0.00001 USD with a v-digit quote. When the volume increases from 0.01 to 0.1 lot, the cost of one betoken for a trader will also increase 10 times.

If the quoted currency is USD, the calculation will be equally follows:

(price of 1 point with a minimum book of 0.01 lot) * trade volume / min. volume * 100 pips

With a trade volume of 0.02, we get: 0.00001 * 0.02 / 0.01 * 100 = $0.002

If the quoted currency is non USD, yous volition start need to calculate the pip value in USD.

With a minimum book of 0.01 lot, the value of 50 pips will be fifty times the value of 1 pip. For example, the cost of 50 pips of the EUR/JPY currency pair will exist 0.001 yen (cost of one pip) * l = 0.05 yen. The value of 50 pips will increment by how many times the merchandise volume is greater than the minimum.

For a Forex trader, there is no difference. For stock traders, ane bespeak is considered to be the minimum price change.

To do this, you demand to multiply the point value by the number of pips in a profitable merchandise. Side by side, the resulting value should be converted into the currency of the trading account based on the current charge per unit.

The content of this commodity reflects the author's opinion and does not necessarily reverberate the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered equally the provision of investment advice for the purposes of Directive 2004/39/EC.

Source: https://www.litefinance.com/blog/for-beginners/pips/

Posted by: adamence1987.blogspot.com

0 Response to "O Que É Pip Forex"

Post a Comment