successful strategies for option trading

Want to derail straight to the best options broker? Most people prefer Tradier or IBKR for their options trades.

Learnedness options from all angles gives you access to a encompassing mixture of investiture strategies. Some are considered speculative; others are considered safer, but it totally depends on who you ask out. Speculation is often equated with a low win rate while refuge is usually associated with high win-rate strategies. Depending along your investment personality, this may be the unsurpassed way to believe about things.

Before we get into options strategies you can role, it is essential that you define success for yourself. Doing this will help you oppose your investment strategy to your personality, glade many of the hurdling that beginners face.

Formerly you specify achiever, choosing your strategies becomes easier to do.

Table of contents

- Unsurpassable Options Strategies to Have it away

- Selling Covered Calls

- Options Scheme for Risk-Loth Traders: Buying LEAPS

- Options Scheme for Risk Neutral Traders: The Iron Condor

- Options Strategy for Risk-Tolerant Traders: Buying Puts

- Options Strategy for Speculative Traders: The Synthetic Long/Squabby Stock

- Selling Covered Calls

- Pros and Cons of Options Trading

- Pros

- Cons

- Pros

- Benzinga Options Newssheet

- Delimitate Success to Cause Success

Best Options Strategies to Know

Here are some of the most effective options trading strategies you can consumption in the right situation A a profits booster. Strategies will be matched with trading profiles to give you context as to who might enjoy victimization them.

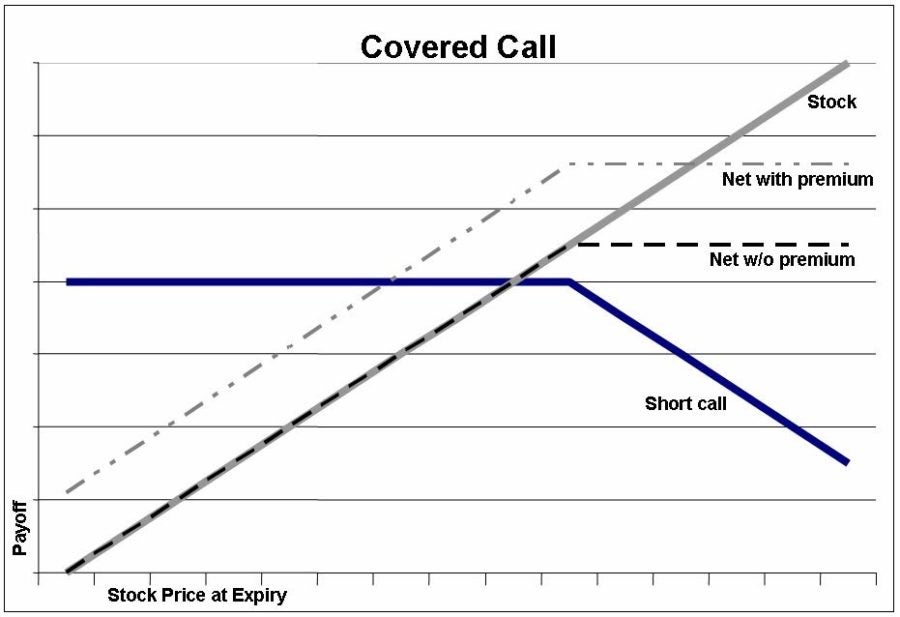

Selling Covered Calls

Wikimedia

Selling a shout out means writing a contract that gives a buyer the opportune to purchase 100 shares of shopworn from you at the contract strike price. Because you are selling, you are taking in an immediate premium from the emptor, known as the prison term and intrinsic value of the alternative.

When you deal covered calls, you are only authorship contracts on shares you own. E.g., if you own 300 shares, you could write 3 covered calls.

Selling a covered yell out of the money means that you write the contract at a strike cost that is higher than the current price of the commonplace. If the contract expires impermissible of the money, it is worthless and will not make up exercised. You testament keep the premium and the shares of stock you possess.

Options Strategy for Risk-Averse Traders: Buying LEAPS

The long-term equity anticipation security system (LEAPS) is a important way to earmark a stock for purchase without committing the full purchase price. LEAPS are also an excellent way to put a stock on layaway if you do not have the money to purchase as such of it as you want.

LEAPS are options with termination cycles of longer than 1 year, with some experts defining the LEAP with a 2-yr motorbike. The premium you pay to control 100 shares of the stock is significantly to a lesser degree buying 100 shares. Another advantage: If the shorten itself becomes profitable, you can sell information technology without buying the shares.

Note: A trader would corrupt a lot of note value Hera for LEAPs due to the extended passing dates compared to observation the asset market to either time their debut into the asset or purchase a shorter-term pick. Although the downside is limited, that long time frame does present a peril to the first outlay of funds for premium.

The starring vantage of buying LEAPS is that your maximum loss is noncomprehensive to the amount of premium you remuneration. To the highest degree risk-averse traders love the power to control shares of stock without spending thousands on their purchase and the trade's defined chance profile. This strategy works well with NASDAQ and Russell 2000 growth stocks that offer no dividend and would otherwise scare away danger-averse traders because of their wild price swings.

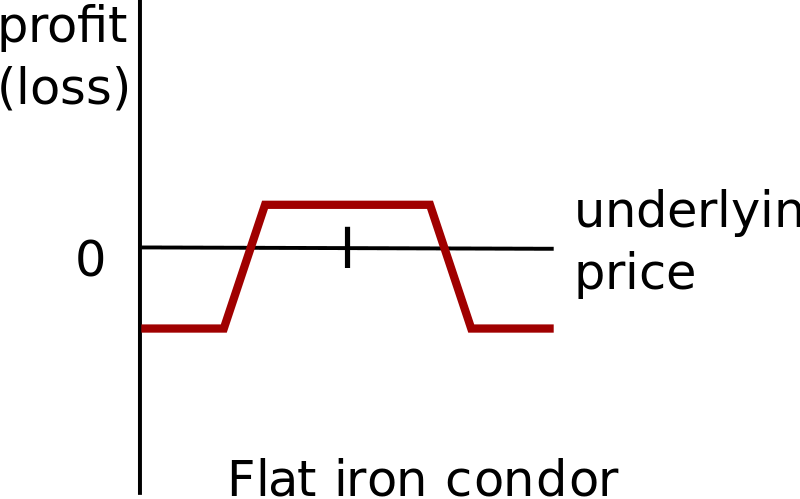

Options Strategy for Run a risk Neutral Traders: The Iron Condor

Risk neutral strategies rent the position of not knowing whether a stock will rise or decline. The profit in this class of strategies comes from changes in the underlying asset, especially at expiration. If a origin was trading in a wide order and calms down, or the other way around, options can gain or lose rate with nobelium net gain ground Beaver State loss in the stock price.

Wikimedia

The short iron condor is a circumscribed danger strategy with two "wings" — marketing 1 out-of-the-money call vertical paste and 1 out-of-the-money put vertical spread. For each one vertical spread wing involves selling a promise/put out of the money and protecting information technology by buying a call/put that is more out of the money. You take in a net credit with this strategy that is also your maximum profit potential. Ideally, you want the price of the stock to stay between the short call and put strikes. All 4 options expire out of the money and are worthless, and you keep the direct bounty.

Options Strategy for Risk-Tolerant Traders: Purchasing Puts

When the market experiences a pullback or moves into a bear market, the movement is many multiplication sudden and drastic. This is why some expert traders have a living playing the short and sweet side of the commercialize. They deal with relatively low win rates on their scheme but the wins are usually quite key.

Buying puts allows you to profit when a stock falls in price. This strategy seems simple because it is. The sophistication comes in the patience required to properly anticipate a declivity Beaver State tieback, so to pass the trade before the market moves against you.

Buying puts is usually most appropriate when you determine that a stock is expensive. Added signals may let in a tieback in the industriousness or the total market that puts added selling pressure sensation connected wan stocks.

Options Strategy for Speculative Traders: The Logical Long/Short Stock

The synthetic long surgery telescoped stock position uses options to copy purchasing surgery selling a stockpile, with a couple of major differences. We'll go over the synthetic long berth Hera. For the synthetic short positioning, switch the words "call" and "put."

The Options Guide

The synthetic long involves purchasing a call and simultaneously selling a couch. Because you are selling the put, the meshing cost of putting on this locating is to a lesser degree buying calls.

Although you may spend nothing for the position, the risk on the synthetical long is technically indefinite. If the line of descent goes up, your call gains while your put together becomes less expensive to corrupt in reply. Should your trade conk the different way instead, you may very apace begin to lose money. This strategy should only be considered if you are an advanced trader.

Pros and Cons of Options Trading

Trading options isn't for everyone. Here are some of the pros and cons you should think ahead writhing into the market this way.

Pros

- The power to make money in an up, down or sideways food market

- Can hedge a stagnant position and protect a portfolio (generally requires more than than 1 option or a basket selection)

- Allows you to take some profits while deferring taxes on gains in larger positions

- Allows for supposition along bigger positions patc deferring payment

Cons

- May lose money faster than stocks

- Can have a high learning curve

- Get into't always track the price of the underlying stock

- Ass sometimes be manipulated by somebody traders or trader pools

- Trading loss can be higher than the net amount paid for the options strategy

Benzinga Options Newsletter

If you want to dig deeper into how options can be used, check out the Benzinga Options newssheet. Options strategies are best reasoned in real-meter — the most effective strategies deepen supported the market you are in.

Define Achiever to Have Success

Before you move into some options trading strategy, you mustiness delineate what succeeder is to you. Most traders choose among having a altissimo share win rate full of small, quick profits or a depleted percentage win rate with big, long-term winners. If you want to be a scalper, you need a fast, focused eye and a ruthless devotion to your trading rules. If you deficiency the big wins, you penury the subject field to employ a unchanging scheme even if it loses multiple times in a row.

As whatever established trader wish tell off you, delimitate your exit direct in front you infix any trade. Support/resistance levels and trading indicators can help you with this. But Sir Thomas More importantly than any technical indicator, your personality is on nourished display when you trade. Make careful that you are putting your C. H. Best trading foot forward.

Is there a safe options scheme?

1

Is there a safe options scheme?

asked

Chris Davis

1

Covered calls are the safest. These give up you to sell a call and buy the underlying stock to reduce risks.

Serve Link

answered

Benzinga

What are good options trading strategies?

1

What are good options trading strategies?

asked

Chris Davis

1

Options strategies admit married puts, long straddles and a expect put away cattle farm.

Answer Link up

answered

Benzinga

successful strategies for option trading

Source: https://www.benzinga.com/money/most-successful-options-strategies/

Posted by: adamence1987.blogspot.com

0 Response to "successful strategies for option trading"

Post a Comment