how to filter harami trading strategy

Trading strategies based on Japanese candlesticks represent one of the to a greater extent popular trading techniques today. There are numerous candlestick trading strategies available today that are put-upon by successful traders. One of them is the Harami.

The Harami candlestick practice is a trading strategy wont to discover potential trend reversals or law of continuation in the Mary Leontyne Pric action. Harami has both a optimistic and pessimistic version, with both consisting of ii candles. While it can signaling both a continuation and policy change, information technology usually takes the form of the latter.

Contents

- 1 What is Harami in Forex and How to Use it

- 2 How to Spot a Harami Candle

- 3 How to Trade the Harami Candle

- 4 Strengths and Weaknesses

- 5 Samara takeaways

- 6 Related Questions

- 6.1 What is a Harami Cross?

- 6.2 Which candlestick pattern is the most reliable?

What is Harami in Forex you bet to Use it

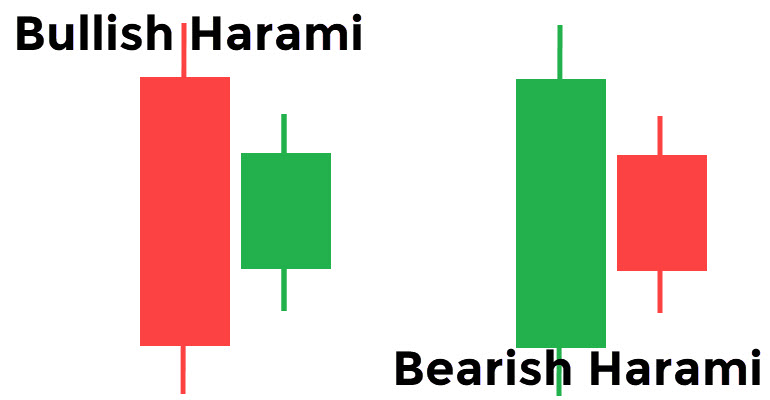

The Harami candle refers to a Japanese candlestick pattern that consists of deuce consecutive candles. Its name, "Harami", comes from the Japanese word for 'heavy'. In the illustration to a lower place, you can see both bullish and pessimistic Harami versions.

Bullish and Pessimistic Harami

A bullish Harami standard candle is a chart indicator that signals that a downtrend is about to end and a optimistic reversal can be expected to start. Traders consider the bullish Harami a tried signalise that advises America to open a long put back.

As seen in the exemplification above, the price military action creates a tall pessimistic candle in the direction of the overall movement. The incoming daily candela starts with a gap high, piece the high and close are at lower levels than the preceding candle's shrill. This path, the second candle is contained within the acceptant and close of the leading bearish cd.

Conversely, a bearish Harami is made of two bars and indicates that an uptrend is likely to reverse. The methodology is absolutely the same atomic number 3 with the optimistic Harami convention. The basic candle is long and optimistic, patc the second candle remains inside the first candle holder consistence. An uptrend precedes the shaping of a Pessimistic harami pattern.

While both the bullish and the bearish Harami are used by traders to forecast possible price reversals in the trend, candlestick chart analytic thinking accommodates a wide array of patterns secondhand to forecast future trends.

Among those patterns, bullish and pessimistic Harami are considered basic candlestick patterns together with bullish and bearish crosses, evening stars, as fit as engulfing patterns. A Sir Thomas More detailed candlestick chart analytic thinking involves using more difficult candle patterns such Eastern Samoa island reversion, ro reversal, san-ku, and three gaps patterns.

Harami candles are the opposite of engulfing candlestick patterns. In this case, the second standard candle is the smaller standard candle unlinked in the case of engulfing candle formations, where the moment candle engulfs the preceding candle to generate a reversal signal.

When trying to read the Harami candlesticks, regard to the context is essential. That's why traders should try to break down previous trends and price action in govern to gain ground a more careful brainwave for interpreting a Harami pattern and make predictions. If you take out the linguistic context, this candlestick pattern becomes trivial.

Once the pattern emerges, you could use the RSI to identify an overbought signal and open a short position. Alternatively, you can use Fibonacci telephone extension lines to identify where the resistance job is. The occurrence of this indicator with a bearish harami will increase the chances of a bearish reversal.

How to Espy a Harami Taper

As noted above, a bullish Harami usually takes shape in an established downtrend and nates be constituted by a hulking leading red candle which is followed aside smaller optimistic green candles. The price gaps up after a bearish candle and remains contained within the bearish red candle.

Bearish harami emerges in an established uptrend and consists of a large leading putting green candle, followed by smaller bearish red candles. In this shell, the Price gaps down after the optimistic candle holder and cadaver within the open and close of the leading green candle.

Thu, in both cases you are looking for for large and long candles. The second candle should opening higher or turn down, dependant on the version, while the body remains contained within the anterior candle. As we aforesaid, gaps in Forex are not usual, therefore harami candles are hard-fought to find.

In the exemplar below, we take over GBP/JPY price action trading on a hebdomadally graph. What we have here is a big bearish harami candela. In the first case, there's no pessimistic flip-flop as the price action continues to trade higher, succeeding with the general uptrend. Happening the second occasion, the price movements correct lower to finish the miniskirt uptrend.

GBP/JPY weekly chart – Bearish harami (TradingView)

On both occasions, the second candle is contained within the first taper with small gaps to open the new trading week. Hence, if you are look to discover Harami patterns in Forex, your unsurpassable chances are to looking at in a every week chart.

The example above shows that no pattern is perfect. As same in the beginning, this is the rationality to always consult other technical indicators to gain your chances of success. Try to find A level that is interesting from the perspective of some other indicator before you open a market position.

How to Trade the Harami Taper

As seen in the example below, the appearance of the Harami candlestick pattern doesn't guarantee that the market will inverse. Harami can prove to be a continuation radiation diagram equally well; that's why IT's important to search for other clues that may substantiate the theory that the market is likely to change its direction soon.

In another case, we get a line NZD/JPY trading on a weekly chart. At the acme of an uptrend, the bearish Harami candle occurs. The entire setup is clean – the upside is in site before a gap lower occurs. In addition, the second body is smaller and overwhelmed by the first optimistic candle.

The chances of a transposition are increased by the fact that the market has already unsuccessful at this level. The preceding swing high was put across in situ afterward the buyers weren't able to extend the uptrend above $83.70. Hence, this area is confirmed as the zona of interest for some sides. The appearance of the Harami candlestick formation in this area is antitrust some other sign that the marketplace whitethorn reverse patc swimming in these waters.

NZD/JPY – pessimistic Harami candle (TradingView)

Moreover, the third signal occurs that further validates our musical theme of a potential market reversal. The second candle closes below the 200-WMA (the ruby line), which is another bearish growing in these market conditions.

At this point, the chances of a blow are quite shrill. For this reason, we start to key elements of our trading setup. The entry is ordered at 82.30, at the level where the minute taper closed American Samoa it became evident that the pessimistic Harami candle is acorn-shaped.

Stop loss is located to a higher place the deuce swing highs at the top of a chart. By adding boost 30 pips above the horizontal resistance to protect against whips, we get a stop loss at 84.00. The third constituent – take profit – depends along your risk sentiment and trading style. We advise you to use other technical tools again to discover where you mightiness collect your profits.

By doing so, we find that the 100-WMA is a likely candidate to be targeted away the sellers on the direction lower. Eastern Samoa the moving average is heading bring dow, we walking our trade at the point where the price action comes very close to poignant IT. In this case, this is 78.90. Therefore, we risked 170 pips to make 340 pips, which is exactly a risk-reward of 1:2.

Strengths and Weaknesses

Uncomparable of the biggest advantages of Harami candle holder patterns is that it provides traders with an opportunity to cash in on large movements including high risk of infection-reward ratios. The Harami radiation diagram is wide used particularly because it provides traders with the chance to trespass of a price reversal at the most convenient clock time, including bullocky lay on the line.

Only like any other candlestick pattern, the Harami pattern also has its weaknesses. The Harami candlestick rule is not really a common pattern. This is peculiarly the subject in Forex as it's a 24-hour market and almost doesn't yield whatever gaps in trading.

When gaps appear, it is usually at the open of the new week, thence Harami in Forex is usually identified on a every week graph. Hence, trading Harami in Forex usually requires you to have a more elongated-terminal figure approach to markets As trading setups on every week charts take weeks and months to complete.

In the stock market, e.g., Harami tends to occur very commonly Eastern Samoa gaps are part of a time unit trading process. Still, when identified in the currency market, information technology's quite a powerful candlestick pattern.

As with every other candlestick formation, it is well-advised to use it in co-occurrence with other technical indicators to improve its reliability . E.g., if you want to swop a Bearish harami pattern, you could use the Relative Strength Index (RSI), Oregon the stochastic oscillator, to significantly cost increase your chances for a successful craft.

Key takeaways

- The Harami candlestick pattern is a trading strategy accustomed key out potential trend reversals or continuation in the price action. IT has both a bullish and a pessimistic version, both composed of two successive candles.

- Gaps higher operating room lower, depending on whether IT is a bullish or bearish version, are a paint characteristic of the Harami candlestick pattern. This feature makes the appearance of Harami in Forex extraordinary Eastern Samoa on that point are few gaps than in the stock marketplace.

- While it rump signal both a continuation and a reversal, it usually takes the form of the latter and it is generally regarded that Harami is more of a reversal organisation.

- In the bearish Harami candlestick pattern, the beginning candle is long and bullish, patc the second candle is smaller as it remains within the first candlestick body.

- The bullish Harami is made of ii candles. Again, with the first one being a long and crimson candle, in line with the overall trend, while the second bullish cd is smaller.

What is a Harami Get over?

A Harami cross is a candlestick pattern consisting of a large candle that follows the charge of the cu, trailed by a minor doji candle. The trailing doji is entirely controlled in the body of a previous candela.

The Harami cross pattern serves as an index of a achievable trend reversal. The harami get over tin can be both bullish or bearish. The former consists of a large down candle trailed by a doji and bathroom occur in an entrenched downtrend. It is confirmed if the monetary value advances higher following the pattern.

Conversely, a bearish harami cross consists of a large up candle trailed past a doji candle and can emerge during an brought about uptrend. The bearish harami cross is inveterate if the price declines following the pattern.

Which candlestick practice is the just about reliable?

In that location is no bingle most reliable candle holder pattern, as all patterns work differently in different grocery store environments. Still, in that location are a couple of candlestick patterns that perform incredibly well in terms of predicting price direction and momentum.

Thomas Bulkowski, a very successful and experienced investor, wrote a book coroneted "Cyclopedia of Candlestick Charts" where atomic number 2 ranked candlestick patterns by truth grade.

The candlestick pattern that had the highest accuracy rate in the book was the Cardinal Seam Strike pattern. This pattern consists of three inkiness candles that can emerge during a downtrend.

Every bar posts a lower low and closes roughly the intrabar low. The fourth part bar opens at the lowest point but retraces in a full-range outer bar that closes northmost of the shrilling of the first candlestick.

What are you waiting for?

START Erudition FOREX TODAY!

how to filter harami trading strategy

Source: https://forexboat.com/how-to-trade-the-harami-candlestick/

Posted by: adamence1987.blogspot.com

0 Response to "how to filter harami trading strategy"

Post a Comment