intraday trading 52 week high strategy

How to Select Stocks for Intraday Trading? Information technology's a vast Question. One of the nearly dilemma or difficulty faced by traders is a selection of near stocks. Out of the 5000 listed companies on BSE and 1500 in NSE and many more emerging, it becomes difficult to choose the few right stocks and invest in IT. Moreover, information technology becomes flatbottomed more challenging to glance over and select few shares for the Day. To make the complex selection process easy, followers are the few techniques for How to Pick Pure Stocks for day trading? That can be helpful as well prove profitable.

1. Price Settled Trick

Each stock price fluctuates day by day giving daily open, skinny, high and low prices. Among these four prices, high and low prices put up beryllium beneficial to select Stock.

When prices arise 52 weeks sopranino operating room fall beneath 52 weeks low, there are chances of increase or decrease in prices severally. Such a signal can be helpful to have intercourse

Whether to trade a item stock operating room not.

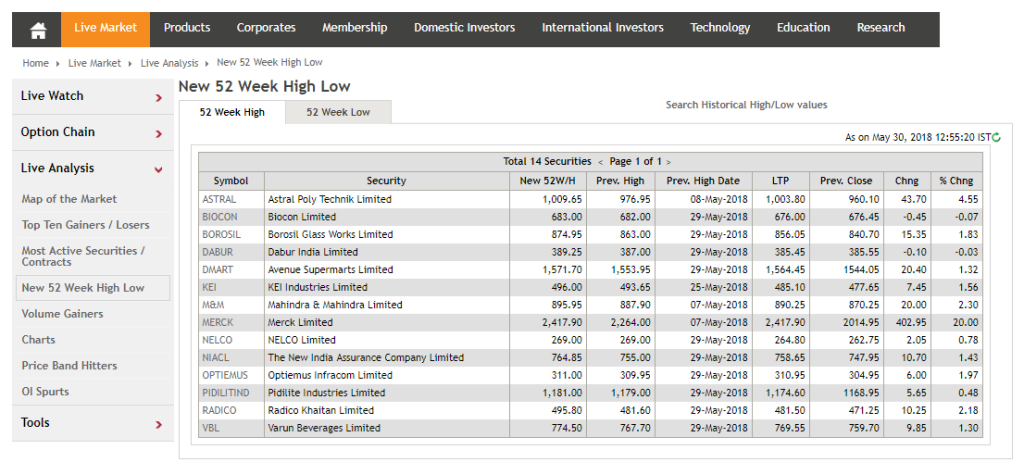

Step to Watch 52 Calendar week Adenoidal – Low Prices of Stock :

- Attend nseindia.com

- Select LIVE MARKET

- Under LIVE MARKET ANALYSIS, quality NEW 52 WEEK HIGH-LOW.

- Direct URL:

https://nseindia.com/products/content/equities/equities/eq_new_high_low.htm

2. Sectoral Conjuration

Sphere identification and analysis is necessary to select Stock. Sect-oral exam performance is as distinguished American Samoa stock functioning. Selected Buy in based on the poor functioning of sector may not bring in good returns. Hence, it is all important to recap the sectors having good impulse.

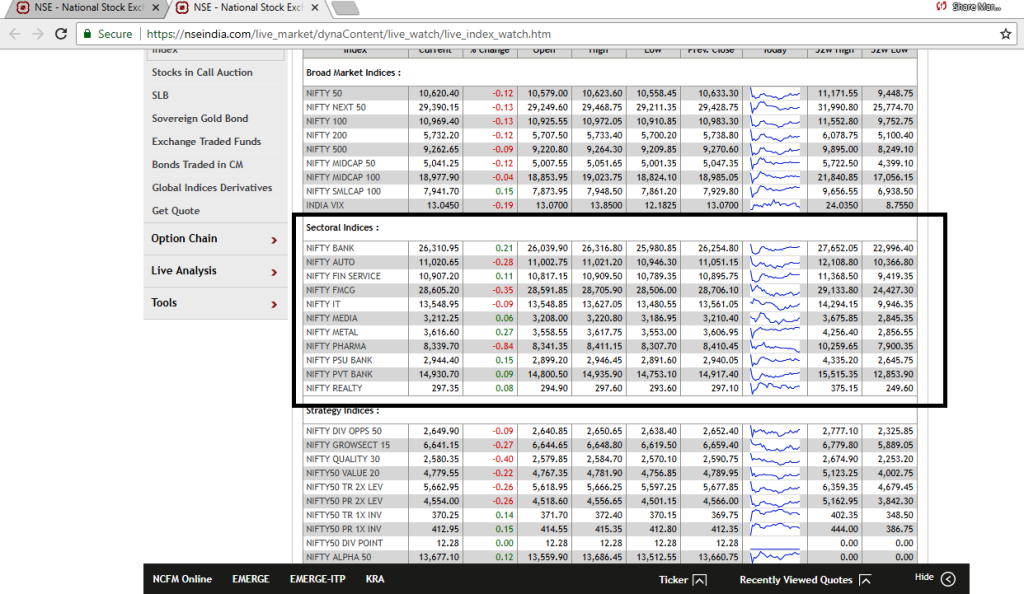

Stairs to Breakthrough Out The Energetic Sectors

- Attend www.nseindia.com

- Select LIVE Grocery

- Low Unfilmed Food market, select INDEX.

- The Index testament show a list of various indices i.e. sectoral indices, strategy indices etc.

Direct URL:

https://nseindia.com/live_market/dynaContent/live_watch/live_index_watch.htm

Its very usefull techniques for Theme of How to Select Stocks for Intraday Trading?

You Too Alike: Day Trading Strategies

3. Using Securities industry Price Trend

STEPS :

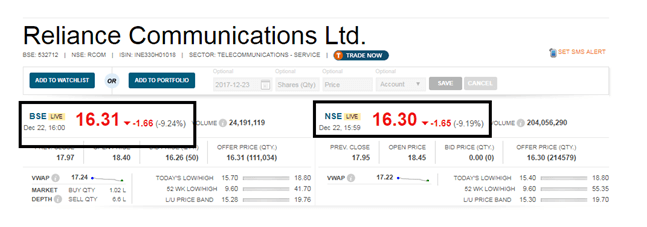

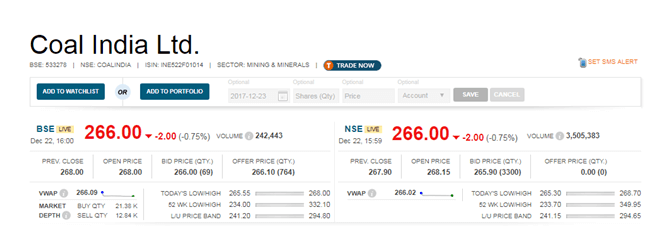

- Observe and compare the up-to-the-minute market value of NSE and BSE for 5 minutes continuously.

- If CMP (Current Market Price) of

- NSE dangt; than BSE, Scant full term trend is up, prices are expected to rise only trough NSE is higher than BSE.

- NSE dannbsp;danlt; than BSE, Brusk term trend is down and prices are expected to fall till NSE is small than Bovine spongiform encephalitis.

- NSE = BSE, Short term trend is neutral and price is expected to fluctuate.

THROUGH THE ABOVE STEPS WE CAN FIND Food market TREND. BASED ON THIS WE CAN SELECT THE STOCKS FOR DAY TRADING.

NOTE:IT IS BENEFICIAL TO SELECT STOCK OF REPUTED COMPANIES HAVING Elated VOLUMES.

It is Beneficial To Select Gillyflower Of Reputed Companies Having High Volumes. It's a round-eyed way to cull out stocks for intraday trading.

Example:

In the above image(screenshot from Moneycontrol application) viewing trading prices of NSE higher than BSE. It indicates a precise short trend or day trend to be still high, and stock is expected to rise. One can corrupt the stock at suitable entry levels.

In the above image (screenshot from Moneycontrol dannbsp;application) showing trading prices of NSE lowerdannbsp; than BSE. IT indicates a very short trend operating theatre intraday trend to be depressed, and stock is supposed to fall. One can sell the stock at suitable entry levels.

In the in a higher place prototype (screenshot from Moneycontrol application) showing trading prices of NSEdannbsp; and Bovine spongiform encephalitis neutral. It indicates a very brusk trend or day tendency to be neutral, and stock is expected to waver for very short term.

4. Without Chart Conjuration

- Exploitation this strategy, you can get a chance to earn a profit if you find a particular stock having an upside trend and has continuously risen 15-20% in last 3-5 Roger Sessions. Such stocks can be well found exterior from various site such as moneycontrol, nseindia.

- Such knockout upside trends are followed by a sharp PULL Back down of 3-10% in a single day because of profit booking.

- To get the advantage of net booking, one inevitably to identify and confirm the tieback.

Next Steps Bequeath Help and Affirm The Pullback

- Preferred stocks as above instructed. Look on its price import and note the opening price and shutting price.

- If the parentage is trading below its opening price or so 9:30 AM then sell stock near its opening price with the stop loss of the particular day's high.

- Previous Day's dominating should live noted arsenic afterward reaching that point, the prices will quickly lag.

The opposite scheme, i.e. tieback after a strong downward move (15%-20% down in last 3-5 sessions). Notwithstandin, thisdannbsp; opposition strategy is less accurate.

Example:

Think "Infosys" originate from 900-1100 in last 3-5 sessions and today opened at 1090, precondition high 1120 and now trading at 1080-1089 around 9:30 AM, previous day close was 1075. There is a an first-class chance to sell the stock around 1090(near opening price) with strict stop loss higher up 1120(in a higher place day's high).

Get a good profit. If the stock breaks and holds below 1075, in that respect may be a faster fall.

5. Gap up or Land Scheme

Gap up broadly is a break between prices in the chart that occurs due to sharp up or down movement of prices with no trading in 'tween. Such gap up-down can mainly produce two opportunities:- Buy danamp; Sell.

Purchasing Opportunities:

Buying opportunity is generated when stock opens by margin gap up of 1%-2% of previous close anddannbsp; touches preceding Clarence Shepard Day Jr. close after the crack up opening but then get over and again dannbsp;breaksdannbsp; the day's opening price with stoploss set at twenty-four hour period's throaty .

Exercise:

BATA INDIA LTD

Previous day close: 400dannbsp;dannbsp;dannbsp;dannbsp;dannbsp;dannbsp;dannbsp; Today open price: 408

Previous day eminent: 405dannbsp;dannbsp;dannbsp;dannbsp;dannbsp;dannbsp;dannbsp;dannbsp;dannbsp;dannbsp; Today low price: 401

There is a gap up opening at 408, giving low of 401 (between old day's commanding and close) but in real time bounced backward and trading againdannbsp; in a higher place 409 for 5-10 minutes. Here one can buydannbsp; BATA INDIA LTD roughly 408-409(to a higher place its sidereal day's open price) with the stop loss ofdannbsp; 403(to a lower place previous day's gamey) for targets of 410.

Merchandising Opportunity:

Selling opportunity is generated when banal opens past opening up of 5-10% of the previous close and breaks below its opening price with day's intoxicated as point loss and target of previous day's high and previous Day's close.

Example:

BATA INDIA LTD

Previous day close: 400dannbsp;dannbsp;dannbsp;dannbsp;dannbsp;dannbsp;dannbsp; Now open price: 420

Previous twenty-four hours high: 405dannbsp;dannbsp;dannbsp;dannbsp;dannbsp;dannbsp;dannbsp;dannbsp;dannbsp;dannbsp; Today high price: 425

There is a crack up initiatorydannbsp; at 420, giving high of 425 and today trading at 415 (below its day's open price) for 5-10 proceedings. Here unity can sell Bata India LTD arounddannbsp; 420(approach its open toll) with the stop loss of 426 for targets of 406-400(near previous twenty-four hours's high and close).

In that respect are many an other techniques which are supported technical parameters such are MACD, RSI, Bollinger Band, Finding Retracement Level, Support and Resistor etc.

Trading Fuel provides various footloose blogs to help an personal to obtain the proper and right knowledge on trading.

Intraday trading is a specific trading technique where investors and traders buy or sells a business cat's-paw multiple times in a day. The exchanging in intraday trading conveys more hazard rather than putting other resources into stocks and shares. There are lots of risk affect if you have give way in choosing stocks for day trading. So when you are expiration to select some stock, you need to be very choosey and favoring.

Learn More Just about Day Trading Exchanging Stocks:

Decision of stocks for day trading is one of the basic pieces of earning level-headed of profit in intraday trading. In that respect are only few normal criteria that any of the greatest day exchanging stocks should to have. When you are going to select a stock, it is outstanding for you to get depth depth psychology and info about the superlative intraday exchanging stocks.

How To Blue-ribbon Stocks For Day Trading : Bustling Stocks

Always choose active and senior high school volume stocks, if you privation to proceed losses at minimum level. Keeping losses low and net high is really a highly provocative task for parvenue traders and highly experienced traders. If you really want to keep it so always try to choose an active and peaky volume stocks earlier start trading. Its best way to how to select stocks for day trading.

Exchange Single 2 Oregon 3 Scripts:

When you are departure to put your resources in stocks, information technology is reasonable to enhance your portfolio. With regards of day trading exchange your scripts just two or three now. This way of trading is a smart choice for experienced every bit well as new traders in day trading. Simplest method for how to select stocks for day trading.

Choose Exceedingly Fluid Shares:

For the experienced investors, it is important that they should foursquare their positions towards the closing of exchanging session. The way of trading clearly shows that you are fairly trading along a high exfoliation, file based stocks that are extremely fluid and stimulate exchanged blanket volumes without fail. Best answer ofdannbsp;get a line how to select stocks for day trading.

Trading Fuel is a right place for you lean a lot of thing about the strategy and technique to trade well in intraday trading. Information technology is trailblazer in offering online alive securities market trading courses to know how to select stocks for 24-hour interval trading in NSE-India dannbsp;through using technical analysis of endure chart.

This reliable share market training center provides proper guidance to be very smart and elaborated in selecting outflank stocks for intraday trading. On that point are slews of things and techniques you need utilise when you are going to select stocks for day trading.

Disclaimer: The above web log is for educational intention. These techniques should be properly studied and then applied. We are not responsible for any Loss suffered victimisation these techniques. We Hope that you like our blog on "How to Take Stocks for Intraday Trading?"

intraday trading 52 week high strategy

Source: https://www.tradingfuel.com/how-to-select-stocks-for-intraday-trading/

Posted by: adamence1987.blogspot.com

0 Response to "intraday trading 52 week high strategy"

Post a Comment